Download a PDF version of this article

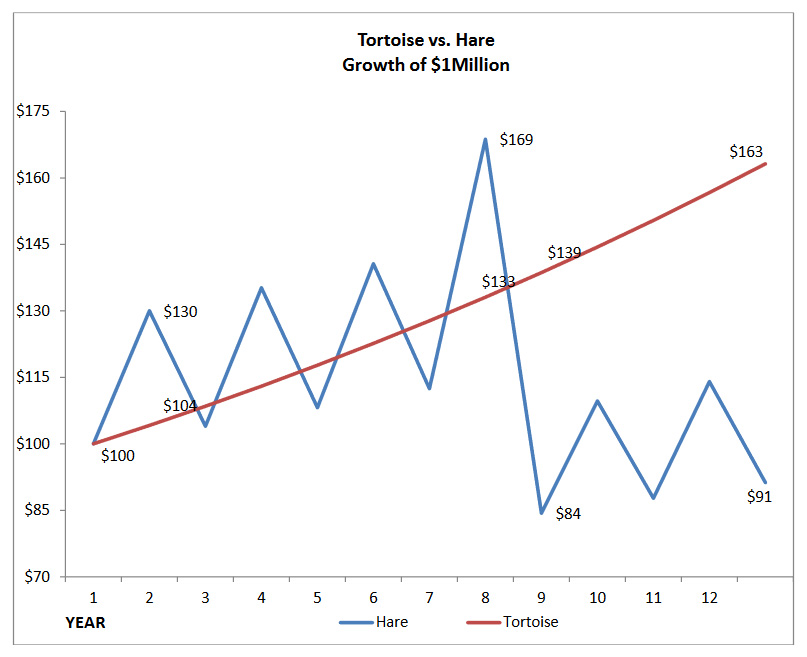

The story of The Tortoise and The Hare illustrates the power of compounding incredibly well. Volatile, inconsistent performance (think of the hare) can take investments up 30% then down 20% and back again in a roller coaster cycle. There are two key elements to remember. 1) Every time you lose 50%, it takes 100% gain to get back to even, and, 2) while “low” interest gains look unimpressive at first glance, the simple act of avoiding losing years means that, in the end of the 12-year cycle, the conservative strategy outperforms the aggressive one by a long shot, since the principal has continually compounded without dramatic fluctuation. (And do I have to mention that you sleep better while NOT on the roller coaster?!)

Note these two investment strategies illustrating the tortoise vs. the hare, or, aggressive vs. conservative: