Footnotes will be a monthly publication which follows our “First Friday” webinar presentations each month. The goal of the Footnotes publication is to summarize our “First Friday” presentation’s most important data points, which will make it easier for The Abernathy Group Family Office members to make intelligent decisions based on facts and data – as opposed to potentially conflicted opinions – from the mainstream media.

Click here to view the corresponding First Friday Video

Commentary from the January “First-Friday” meeting:

January’s “First Friday” meeting focused on the most relevant and insightful questions posed by the families we serve during the last 12 months. Here are the “Footnotes” from this meeting.

As a short reminder to each Family Office member, The Abernathy Group Family Office has now had 12+ “First Friday” webinars. All of them are available on our website and “YouTube” Channel if you would like to go back and see how we have interpreted the economic signals, while doing our best to cancel the noise over the last year plus. Our goal: to help our Family Office members save time and make intelligent decisions by ignoring information with little predictive power and focusing on data with the highest probability of telling us what is to come.

In January’s “Footnotes” publication, we want to focus on the Signals – ignore the noise – and encourage each Family Office member to make intelligent decisions based on facts and data offering information about the likely future to come. As we move forward through 2024, it will become as important to tune out the noise as it will be to focus on the signals. Why? Because debt leverages outcomes. Debt makes good outcomes great. Debt makes bad outcomes disastrous. As this publication goes to press, the U.S. has a record $34 trillion in debt at the national level, a record amount of debt in corporate America, AND a record amount of debt on the balance sheet of our U.S. citizens.

We want to be very clear. Bad outcomes do not have to happen to overly indebted entities. The U.S. economy could find a magic growth pill, without increasing our debt levels. With increased growth, the increased tax revenue (among other revenue generating sources) could repay our debt and return the U.S. to the incredible juggernaut of yesteryear.

However, the odds are against that enviable outcome.

The depressing fact is that we can find no one with an idea about how to repay our debt. In fact, we hear the 2024 and 2025 budgets both call for trillion-dollar deficits (as if money grows on trees and never has to be repaid). This means the debt overhang will remain and grow, after we emerge from the next recession, which will soon create another recession, and at some point, if the U.S. does not repay its debt, the world will issue a margin-call for the U.S… “Disastrous” is the only word that comes to mind if that scenario materializes.

To make matters worse, our citizenry is fractured to the point of physical violence at times. There is no one in sight offering a “Clintonian” solution to run a budget surplus. The U.S. must increase tax revenue and reduce service expenditures, while growing our economy.

This was the difficult decision the Clinton presidency faced in 1992. Reducing government spending, and collecting more tax revenue, while growing our U.S. economy was a difficult pill to swallow. It was viable then. Will our country agree to accept the pain voluntarily, or will we make the world force it on us? As said, I hope for the former.

Painful? Yes.

Necessary? Yes.

___

We thought it would be helpful to clear up some of the uncertainty which confronts us today, by answering 6 of the best questions we have received over the last 12 months.

And by the way, if these questions or answers generate additional questions – or if the answers we offer today are not sufficient for you, please send us your questions in the chat-box at the bottom of your screen – or raise your hand. Marissa will be sure to bring it up at the end of the meeting.

The questions we will start with today are:

Slide 2

- What does 2024 have in store for intelligent investors?

- What are the known risks confronting investors today and what is being possibly overlooked by the capital markets?

- Is the U.S. Federal Reserve winning the battle against inflation? What are the most likely next Fed actions and what does this mean for the investing public?

- Based on the data and reliable signals today, how should intelligent investors allocate their capital to take advantage of the most likely scenario to come, while guarding against a significant downturn triggered by an unforeseen event?

- Which investments offer the best risk reward ratio based on current data?

And of course – the most important questions for every self-respecting analyst – is always to challenge current conclusions – with a “what if we are wrong?” question.

- What would have to happen for you to be convinced your outlook is wrong?

So, let’s take these excellent questions one by one, and see if any of the answers create additional questions from those attending the meeting today:

Slide 3

What does 2024 have in store for intelligent investors?

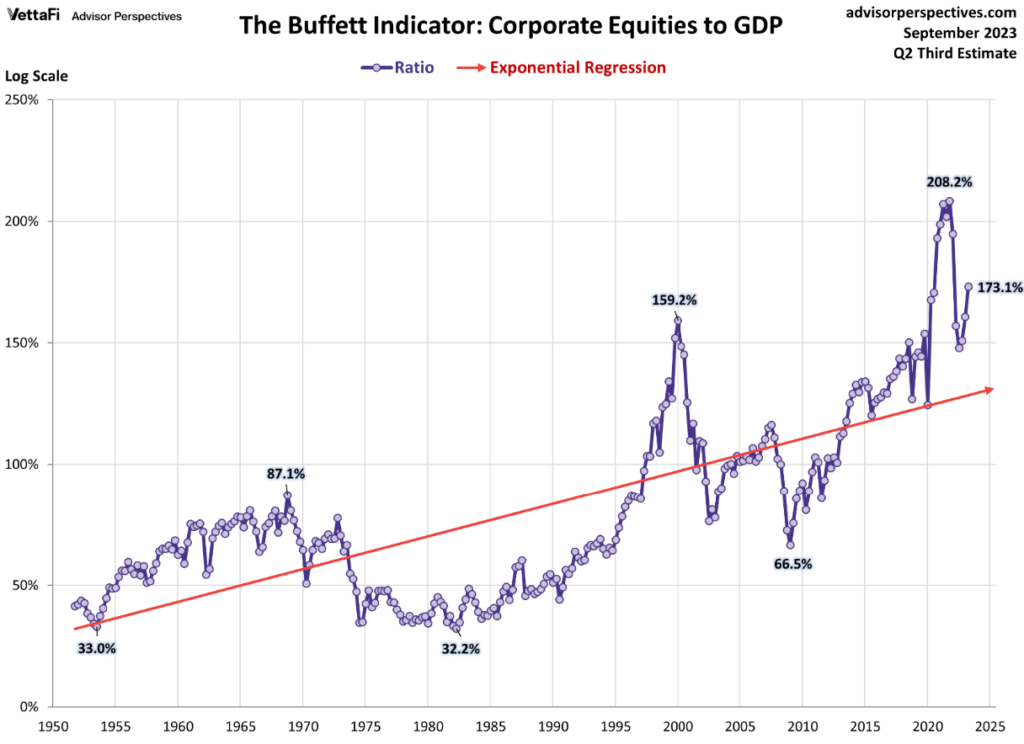

Here are the facts: The U.S. stock market should be priced at 15 X earnings. It is priced at almost 20 X earnings today. This means the market is 25-40% overvalued, based on expected 2024 earnings. However, it is quite possible that 2024 earnings could be lower than the current expectations.

Why would they be lower? Recession is likely in 2024. Debt repayments and interest charges on outstanding debt will put pressure on earnings and growth. Employee costs have risen. Manufacturing costs have risen. Bankruptcies will increase in 2024.

We have discussed the fact that Debt leverages outcomes both positively and negatively. The current amount of national debt, combined with corporate debt, combined with personal debt will increase outcomes AND volatility… both up and down.

Our base case is that markets go up and down with no gains in 2024, if we avoid a recession. If we have a recession – which is the most likely pathway forward, we believe the markets will decline by 25-40%.

Here is the bad news – If we have a recession, equity portfolios will decline without any improvement in the significant amount of debt in our system. The U.S. Federal Reserve will cut rates, and the U.S. Administration may also increase liquidity, which will increase our debt load. Our real fear is that the increasing debt load will lessen the 2024 recession, yet the stimulus used to lessen the 2024 recession will make the following recession more much more damaging.

This debt overhang will remain an overhang for as long as it exists. It will reduce U.S. economic growth as interest payments take priority over growth expenditures. Eventually, this is most likely end badly.

In summary, in 2024 it is likely that we will have a recession. S&P earnings will not grow by the 10% priced into current valuations, and the value of stocks will either turn down or end the year with little to no gain.

The U.S. Federal Reserve will cut rates to lessen the recession, yet the unintended consequences of increasing our debt, will be realized in one of the next recessions making each recession to come more severe.

Slide 4

What are the known risks confronting investors today and what is being possibly overlooked by the capital markets?

As always, there are many more possible risks than the one, or the few, which will become reality. So, let’s discuss the most likely risks which are currently priced into today’s market valuations.

Currently the U.S. stock market is pricing in earnings growth of more than 10% in 2024.

Slide 5

With inflation slowing, wages rising, and the probability of a U.S. recession in 2024, along with the reality that the U.S. consumer will run out of spending capacity at some point in 2024, one of the main risks is overconfidence by the investing public.

We believe earnings will be roughly flat in 2024 if we avoid a recession. If we have a recession history shows earnings decline by 20% on average. If earnings decline, the narrative will become negative and public emotions move from ebullient to gloomy. An overvalued stock market typically declines by more than the earnings decline in an attempt to find fair value. Stock market outlook, lower most likely. No gain best case.

We also live in a troubled world today. The U.S. elections currently have one candidate solidly leading each respective party. Polling shows that 70% of U.S. citizens do not want either candidate to run for office.

Our hope is that there emerges a candidate which can offer both sides of our political system a semi-agreeable alternative. If not, we expect civil outbreaks rivaling or exceeding those in 2020.

Additionally – We currently have 2 significant wars on 2-3 continents. And we have elections taking place in almost 50% of the countries in the world.

As the global economy continues to struggle for growth, we expect more wars to emerge, and we expect the eastern portion of the globe to continue its divide from the western portion of the globe. This global division will incent restructuring of supply chains, changes in currency valuations, and it will increase the risks of a more significant inflation and global conflict.

It is difficult for us to see a scenario where healing, fellowship and solidarity overcome our differences, yet we hope calm and intelligent heads prevail.

Slide 6

Our next question is an easy one:

Is the U.S. Federal Reserve winning the battle against inflation? What are the most likely next Fed actions and what does this mean for the investing public?

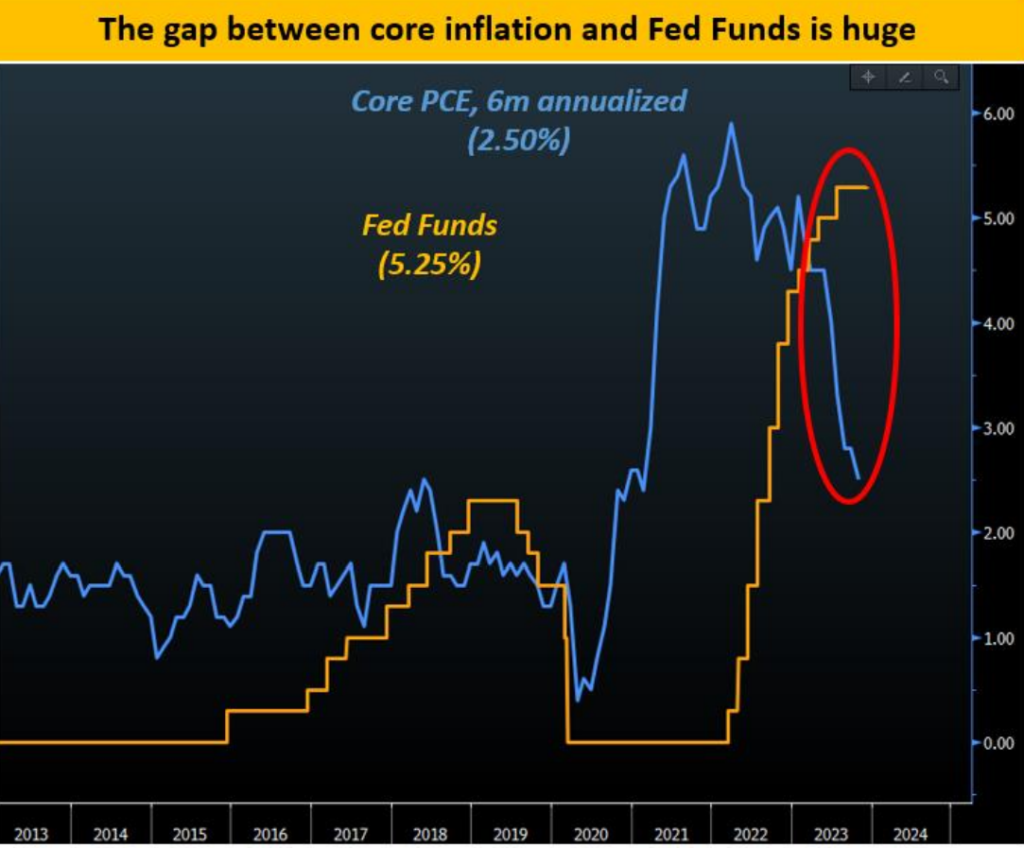

Short answer: Yes. The U.S. Federal Reserve is slowing our economy and inflation is also slowing yet not going away – at least not yet.

We believe – the combination of abundant subsidies for rebuilding supply chains, energy transformation based on climate change, funding wars on 2 continents and paying an estimated $1 trillion in interest payments on our debt in 2024, promise to make inflation a bit stickier than the market believes.

So yes. The Fed is winning the battle against inflation, yet the battle is likely to last longer than the markets currently expect.

What is the Fed’s next move and what does it mean for the investing public?

Slide 7

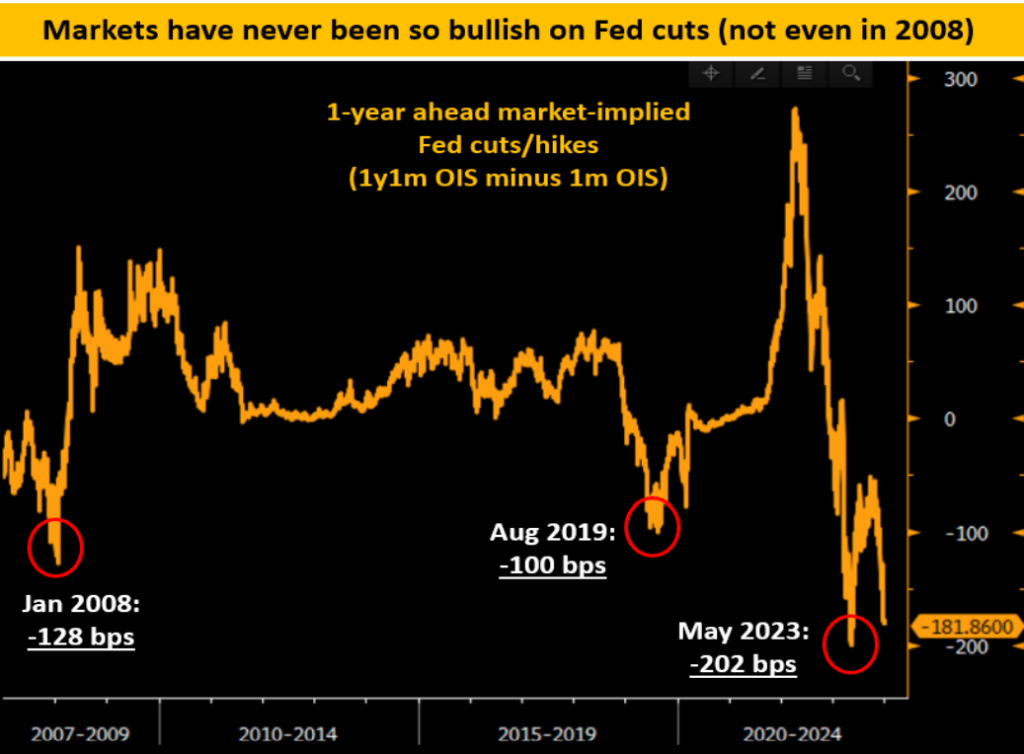

The market has priced in a 90% chance of a rate cut by March 2024. See the above slide.

We believe this is too soon, although we do agree that the next move by the fed is more likely to be a rate cut rather than a rate increase.

Slide 8

As you can see from this slide if inflation continues its current trajectory, the Fed will have to cut rates by over 2.5% in order to bring rates in line with risk/reward balance.

Slide 9

If this scenario becomes reality, investors should be increasing the duration of their bond portfolios on any upward fluctuations of interest rates.

This brings us to our next question which is more difficult to answer. Reason: all investors have slightly different goals and most importantly, different time frames.

Slide 10

Based on the data and reliable signals today, how should intelligent investors allocate their capital to take advantage of the most likely scenario to come, while guarding against a significant downturn triggered by an unforeseen event?

Our belief is that due to the level of uncertainty today, and the potential for magnified outcomes due to the enormous amount of debt outstanding, most investors should focus on controlling risks first, and remaining patient until the risk/reward relationship becomes more attractive.

Our counsel is to maintain a larger than normal level of diversification when uncertainty is high, and systemic leverage is likely to create more volatility than the markets are priced for.

Maintain a more significant commitment to low risk or riskless investments as they are likely to generate more current income today than has been available in almost 20 years.

Commit risk capital to high quality investments as close to book value or under book value, and focus on collecting income rather than capital gains, as income may be the only return available on risk assets. We do not expect appreciation to become a reality until current valuations for risk-based assets become more in-line with historical levels.

Slide 11

Which investments offer the best risk reward ratio based on current data?

We believe riskless U.S. Treasury bills, bonds, and notes, offer an attractive risk reward ratio today and provide a return which is slightly over the current inflation rate.

Alternatively, for those seeking higher returns and willing to take some fluctuation in value over the short term, preferred stocks, and common stocks near or under book value, which are paying significant dividends are likely to become in vogue over the next few years. Most of these income generating investments check the high-quality box, the value-based box, and the certainty of a return-based box similar to real estate investments, yet without the day-to-day management challenges created by owning real estate.

One more point: some of these equity type investments offer tax advantages and will provide a higher after-tax yield than bonds or debt instruments.

The main investment considerations are:

- your tolerance for risk – mainly the ability to emotionally handle the fluctuations which come with all public equity investments,

- your time horizon. If your time horizon is 5 years or more, the combination of low-risk and no-risk investments along with high quality, high dividend paying equities will likely provide an investment portfolio with returns commensurate with a much higher risk, higher volatility investment portfolio, and it will include tax consequences on top of it all.

Slide 12

What would have to happen for you to be convinced your outlook is wrong?

This is the question each of us must answer before making any significant decision.

Is important to understand what may happen if your expectations are wrong. Why? At times decisions based on facts you believe you know create consequences more detrimental than staying the course with your current strategy. See the answer below.

Several events would have to take place to convince me our outlook was wrong.

Firstly, there would have to be a working solution to the reduction of our U.S. Debt. This would likely involve a significant reduction of social services AND increases in corporate taxes, income taxes, and inheritance taxes. This is called the third rail of politics and despite it being the most likely solution, it is the least likely topic a politician could run on – and have any chance of winning.

Who wants to pay more in taxes while receiving fewer social services? Unfortunately, this is the most likely pathway forward. Either our country takes this “road less traveled” voluntarily – or – the world will force it on us. (And as said, that will be disastrous.)

Next, a new candidate for president would have to emerge, able to appeal to the middle of our political system, yet able to tackle our fiscal debt, deficit, and equally important our geopolitical situation and stance in the world. We really need someone who can heal our position as a global leader, interested in finding win-win situations as opposed to structured relationships in which only the U.S. wins at the cost of everyone else. While every cell in my body hopes for this person to emerge, I realize hope is NOT a strategy. (However, crossing my fingers and praying each day, can’t hurt😊).

Finally, if we could put together an administration able to generate growth in our economy significantly over and above the 1-1.5% rate our economy is currently slated to grow, we might find our way back to repaying our debt and maintaining our position as the world’s leading economy.

This is incredibly unlikely as our debt repayments are slated to be approximately $1 trillion per year in 2024 (and will increase in 2025), while our social obligations along with defense spending and healthcare costs will create some incredibly difficult decisions over the next few years.

Slide 13

Absent these 3 minor miracles – it seems as if the investing public’s current expectations are a bit ahead of themselves.

Our counsel to all Family Office members continues to be cautious. We advise reducing risk, focusing on income over asset appreciation. Generating 5%+ returns from reasonably safe investments will be an investor’s intelligent choice. Increase diversification in value-based, quality companies, while remaining patient for an opportunity offering less expensive investment opportunities, increased visibility, and higher levels of certainty. A more fertile investing environment will materialize, often when gloom seems to be at a crescendo. The goal is to ignore noise, follow reliable signals, and protect your capital until a more welcoming environment arrives.